A monetary tightening cycle is historically not the best time to invest in gold, and the current period confirms this rule. Gold has closed lower for five weeks in a row, aiming for two-year lows, which are literally $30 left.

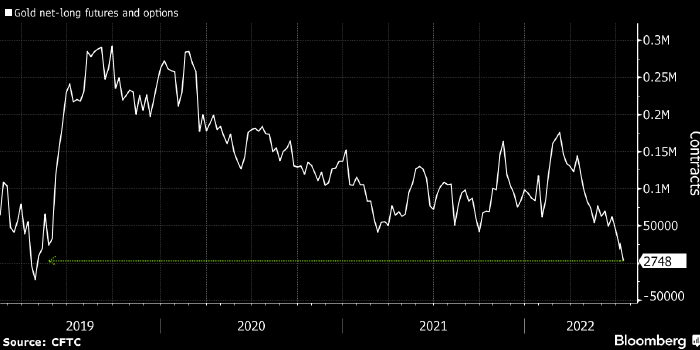

The volume of the net position of large speculators in futures and options for gold in the number of contracts. Data: CFTC, Source: Bloomberg

A monetary tightening cycle is historically not the best time to invest in gold, and the current period confirms this rule. Gold has closed lower for five weeks in a row, aiming for two-year lows, which are literally $30 left.

Gold price chart in 1 week intervals

This is not surprising, given that the futures market for the federal funds rate has priced in a 100% chance of a 0.75% increase at the next FOMC meeting on July 27 and a 20% chance of a 1.00% increase.

All this does not please large speculators, such as hedge funds, which are actively selling the precious metal. In the week ending July 12, their net long positions in gold futures and options fell to their lowest level in more than three years, the US Commodity Futures Trading Commission (CFTC) reported yesterday. At the same time, the volume of short positions of large speculators has reached a record high over the past three years.